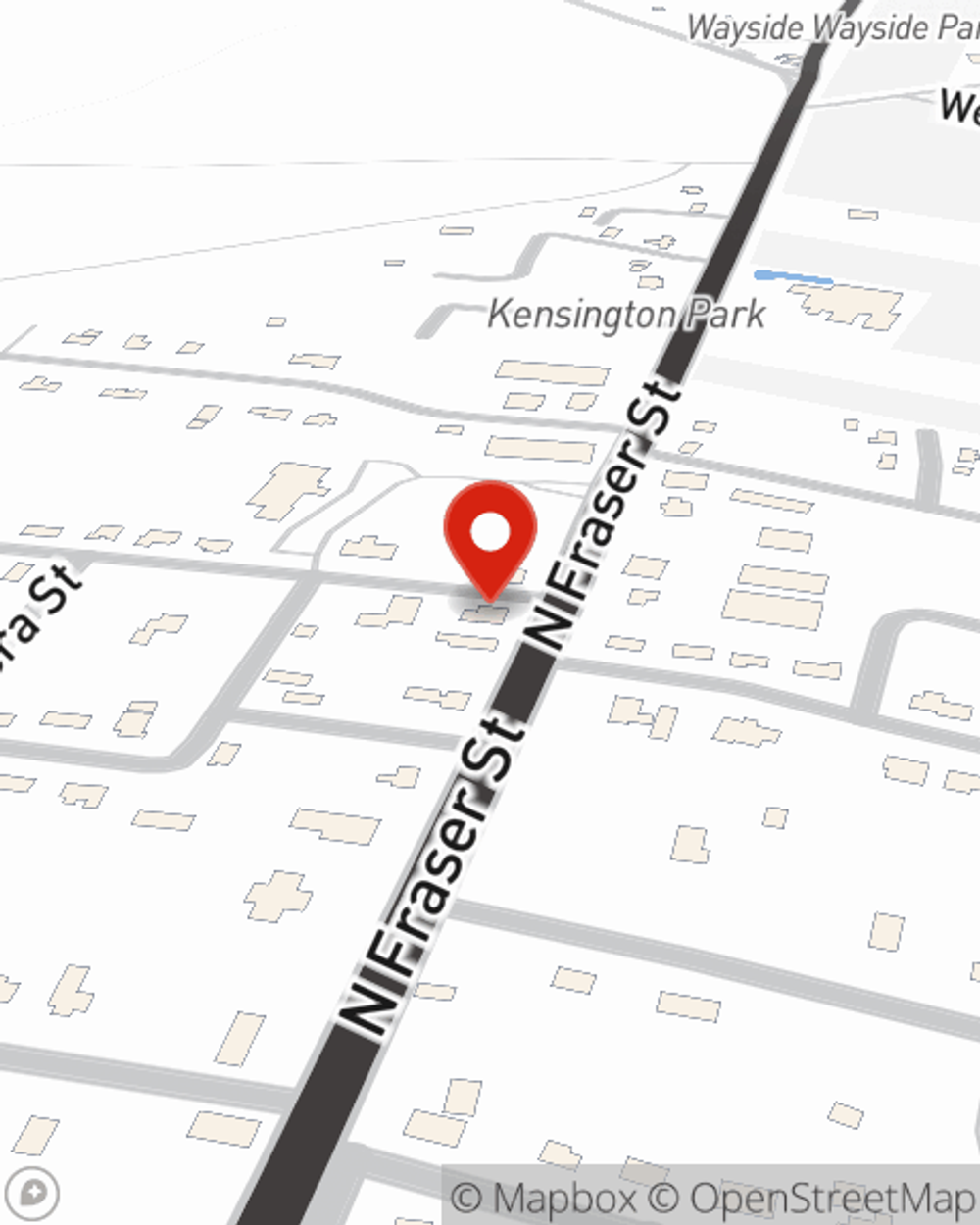

Renters Insurance in and around Georgetown

Looking for renters insurance in Georgetown?

Coverage for what's yours, in your rented home

Would you like to create a personalized renters quote?

Home Is Where Your Heart Is

Think about all the stuff you own, from your couch to smartphone to hiking shoes to fishing rods. It adds up! These possessions could need protection too. For renters insurance with State Farm, you've come to the right place.

Looking for renters insurance in Georgetown?

Coverage for what's yours, in your rented home

State Farm Has Options For Your Renters Insurance Needs

When renting makes the most sense for you, State Farm can help shield what you do own. State Farm agent Mark Nash can help you identify the right coverage for when the unanticipated, like a fire or a water leak, affects your personal belongings.

As one of the industry leaders for insurance, State Farm can offer you coverage for your renters insurance needs in Georgetown. Get in touch with agent Mark Nash's office to talk about a renters insurance policy that can help protect your belongings.

Have More Questions About Renters Insurance?

Call Mark at (843) 436-8000 or visit our FAQ page.

Simple Insights®

Questions to ask your insurance agent

Questions to ask your insurance agent

Insurance needs are ever-changing. Here are some questions to ask an insurance agent to start the conversation and further explore your coverage options.

How does a home insurance deductible work?

How does a home insurance deductible work?

Learn how the homeowners insurance deductible chosen can make a difference with your homeowners premium.

Simple Insights®

Questions to ask your insurance agent

Questions to ask your insurance agent

Insurance needs are ever-changing. Here are some questions to ask an insurance agent to start the conversation and further explore your coverage options.

How does a home insurance deductible work?

How does a home insurance deductible work?

Learn how the homeowners insurance deductible chosen can make a difference with your homeowners premium.